Corporate Social and Environmental Responsibility | The BGL BNP Paribas CSR policy

BGL BNP Paribas: A Major Financial Player Committed to Sustainability

BGL BNP Paribas has a direct impact on Luxembourg’s economy, society, and environment. The bank strives to make this a positive impact and aims to help build a sustainable future for all stakeholders, including clients, employees, partners, civil society actors, and investors. This approach is supported and strengthened by the actions of the BNP Paribas Group, which plays an instrumental role in this community effort globally. The initiatives supported during the health crisis have reinforced the bank’s significant societal role.

CSR Approach

BGL BNP Paribas’ initiatives are built around four pillars: economic responsibility, civic responsibility, social responsibility, and environmental responsibility. Each pillar reflects the bank’s responsibilities to its clients, employees, civil society, and the environment. The CSR policy aligns with the 17 Sustainable Development Goals (SDGs) launched by the UN, which aim to eradicate poverty by 2030. The BNP Paribas Group in Luxembourg has a key role in contributing to this collective effort, ensuring performance and stability while developing a sustainable future.

Our Responsibility

The commitment to sustainable development and balanced growth is more crucial than ever. The current crisis demonstrates the need to intensify efforts to build a more inclusive economy. BNP Paribas in Luxembourg aims to have a positive impact on every level through its CSR strategy built on four pillars:

Economic Responsibility

Ethical financing of the economy creates a social economy beneficial to all. The bank prioritizes supporting the economy sustainably by assisting individuals and businesses in their investments and sustainable development projects.

- Sustainable Finance: BGL BNP Paribas finances the economy responsibly through socially responsible investment (SRI) products that contribute to the success of the UN SDGs.

- Finance4Good: A socially responsible savings account where saved money helps finance projects with a positive social or environmental impact.

- Investment Funds: A range of SRI funds allowing investments in solutions related to climate change or opportunities presented by water challenges.

- myImpact Tool: Developed by Wealth Management to help clients define their investment and/or philanthropy profile based on the 17 SDGs.

Social Responsibility

BGL BNP Paribas aims to manage employment responsibly and ensure that employees work in a fulfilling environment and feel respected. The bank pursues three objectives to foster staff development and commitment:

- Promote diversity and inclusion

- Ensure quality of life at work

- Offer dynamic career management and learning opportunities

The changing mentalities positively impact the bank’s business.

The DHR Interview

“Being a responsible employer means recognizing that a company’s strength lies in its workforce’s commitment. At BGL BNP Paribas, we are united by our values and a promise: ‘To be the bank for a changing world.’ We expect our staff to help us build the bank of tomorrow, in a better and more sustainable world. In return, we invest in our people’s development and offer motivating and varied career opportunities. We also provide a high-quality work environment based on professional equality and respect.”

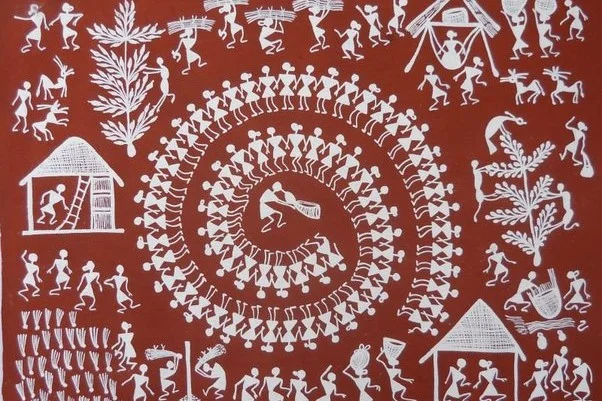

Civic Responsibility

BGL BNP Paribas is committed to society, supporting the development of socially engaged businesses, charities, the social entrepreneurship sector, and microfinance.

Environmental Responsibility

The bank uses all available tools to fast-track the transition to a low-carbon economy. BGL BNP Paribas assists clients with energy transition projects and channels financing and investment flows to initiatives favoring the energy transition by stopping fossil fuel financing. The bank also focuses on eco-friendly technologies and minimizing energy consumption in its buildings, financing green projects.

Albania

Albania Algeria

Algeria Andorra

Andorra Argentina

Argentina Armenia

Armenia Australia

Australia Austria

Austria Azerbaijan

Azerbaijan Bahrain

Bahrain Belgium

Belgium Bolivia

Bolivia Brazil

Brazil Bulgaria

Bulgaria Cambodia

Cambodia Cameroon

Cameroon Canada

Canada Chad

Chad Chile

Chile China

China Colombia

Colombia Costa Rica

Costa Rica Croatia

Croatia Cyprus

Cyprus Czechia

Czechia Denmark

Denmark Ecuador

Ecuador Egypt

Egypt Finland

Finland France

France Georgia

Georgia Germany

Germany Ghana

Ghana Greece

Greece Hungary

Hungary Iceland

Iceland India

India Indonesia

Indonesia Ireland

Ireland Italy

Italy Jamaica

Jamaica Japan

Japan Jordan

Jordan Kazakhstan

Kazakhstan Kenya

Kenya Kuwait

Kuwait Latvia

Latvia Lebanon

Lebanon Libya

Libya Lithuania

Lithuania Luxembourg

Luxembourg Malaysia

Malaysia Maldives

Maldives Mali

Mali Malta

Malta Mexico

Mexico Moldova

Moldova Monaco

Monaco Morocco

Morocco Netherlands

Netherlands New Zealand

New Zealand Nigeria

Nigeria North Macedonia

North Macedonia Norway

Norway Oman

Oman