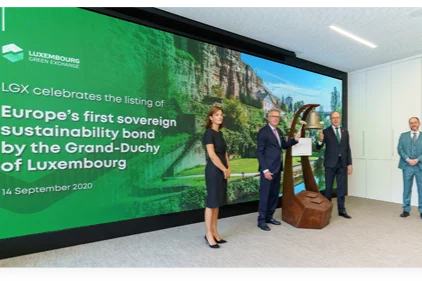

Europe’s first sovereign sustainability bond listed on LuxSE

The Luxembourg Stock Exchange (LuxSE) celebrated today’s listing of Europe’s first sovereign sustainability bond issued by the Grand Duchy of Luxembourg, in the presence of Pierre Gramegna, Luxembourg Minister of Finance. The EUR 1.5 billion bond carries a AAA rating and is displayed on the Luxembourg Green Exchange (LGX).

“Our congratulations go to the Luxembourg Ministry of Finance for this innovative action. With this bond issuance, the Luxembourg Government demonstrates its commitment to sustainable finance and its leading role in the transition to a low-carbon and more inclusive economy. The Luxembourg Stock Exchange is proud to serve as the reference exchange for sustainable securities,” stated Robert Scharfe, CEO of LuxSE.

A Frontrunner in Europe

The sustainability bond was issued under the new Sustainability Bond Framework established by the Luxembourg Government earlier this month. The framework is the first Sustainability Bond Framework established by a European country and aligned with the highest international standards and best market practices in the field of sustainable finance. The framework enables the issuance of green, social, and sustainability bonds.

The sustainability bond listed on LuxSE today has a 12-year maturity, and the proceeds of the bond will finance and refinance social and environmental projects, such as the electric public transportation service Luxtram and the country’s second-largest hospital, Südspidol.

Albania

Albania Algeria

Algeria Andorra

Andorra Argentina

Argentina Armenia

Armenia Australia

Australia Austria

Austria Azerbaijan

Azerbaijan Bahrain

Bahrain Belgium

Belgium Bolivia

Bolivia Brazil

Brazil Bulgaria

Bulgaria Cambodia

Cambodia Cameroon

Cameroon Canada

Canada Chad

Chad Chile

Chile China

China Colombia

Colombia Costa Rica

Costa Rica Croatia

Croatia Cyprus

Cyprus Czechia

Czechia Denmark

Denmark Ecuador

Ecuador Egypt

Egypt Finland

Finland France

France Georgia

Georgia Germany

Germany Ghana

Ghana Greece

Greece Hungary

Hungary Iceland

Iceland India

India Indonesia

Indonesia Ireland

Ireland Italy

Italy Jamaica

Jamaica Japan

Japan Jordan

Jordan Kazakhstan

Kazakhstan Kenya

Kenya Kuwait

Kuwait Latvia

Latvia Lebanon

Lebanon Libya

Libya Lithuania

Lithuania Luxembourg

Luxembourg Malaysia

Malaysia Maldives

Maldives Mali

Mali Malta

Malta Mexico

Mexico Moldova

Moldova Monaco

Monaco Morocco

Morocco Netherlands

Netherlands New Zealand

New Zealand Nigeria

Nigeria North Macedonia

North Macedonia Norway

Norway Oman

Oman